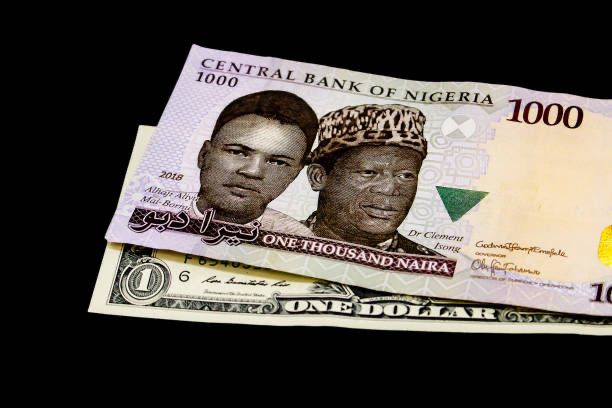

From the beginning of the year, the Nigerian Naira has witnessed a rising disparity with the US Dollar; reaching an all-time highest exchange rate of N1 – $710 in the previous month. Current data shows that the black market sells a dollar for N745. Even with the fluctuating exchange rate, the Central Bank of Nigeria (CBN) data shows that the current exchange rate is N419.39 NGN.

According to financial data from the country’s finance ministry, all sectors of the Nigerian economy are badly affected by the Dollar Naira exchange rate. According to data from Premium Times, the inflation on surging food prices hits a five-year high figure of 18.60 in July 2022. Local businesses are affected by the unending battle against high exchange rates and dollar shortages as they are either forced to adapt or die.

Naira to Dollar

Nigeria has 39.6 million Nano, Micro, Small, and Medium Enterprises (MSMEs). They currently account for 96.9% of the total businesses in the country. They provide 87.9% of employment and contribute about 46.31% of the national GDP, according to data from the National Bureau of Statistics (NBS). From the beginning of the year, these businesses have been faced with the payment system, one in which the weak naira contributes the bulk of the problem.

The rising exchange rates reflect a darkening mood for Nigeria’s economy; one that has been in and out of two recessions in five years.

To add context to this article, Glazia reporter, Adekunle Gbenga surveyed the issues faced by businesses across the country due to the rising naira-dollar disparity. The submissions of the respondents add more insights to the third section of this article.

Why is the Naira weakening against the Dollar?

Since the Fourth Republic in 1999, the naira was exchanged at N92.34 to $1; it further fell to N132.89 in 2004. When President Goodluck Jonathan handed over power to Muhammadu Buhari in May 2015, the naira-dollar exchange rate was N198.914. By 2018, it further fell to N306.08; a situation that has continued till 2022, seeing the naira currently exchanged at N705 in the parallel market.

The weakening naira became even worse with the announcement of the Central Bank of Nigeria in 2021 that it was; withdrawing forex allocations to BDCs in preference for the commercial banks. A move that saw the naira further fall to N520 in the parallel market. However, a day after the currency slumped to a record low at the spot market in July 2022, it rose slightly against the US dollar; strengthening to N430 per dollar from N431, according to data posted on the FMDQ website.

Is cryptocurrency the bad guy?

Economic analysts have attributed the continuous disparity to rising import bills, dollar savings, and the accumulation of cryptocurrencies by Nigerians; who have most likely lost interest in the Nigerian Naira. Others blamed the continuous weakening on the announcement made by the CBN Governor, Godwin Emefiele; that Nigerians buying dollars with naira will be arrested. In simple terms; the demand for forex is high at the moment, while supply is limited, hence the hike in the exchange rate.

Whether or not these policies are responsible for the rising disparity; or the recent efforts by the CBN to prevent this hike further will be of help, none of these factors is good news for businesses in Nigeria; from the fashion, food, construction, and even education sectors. These sectors of businesses depend on consumers’ optimism and sense of financial security to; drive purchases, free flow of local currency, and normal exchange rates for export and import operations. A lot of business owners are currently battling tough financial situations from increasing inflation to reduced profit margins.