As the new year begins, many of us reflect on the past and set intentions for the future. One of the most impactful resolutions you can make is to create a better budget. A thoughtful and effective budget is a roadmap to achieving financial goals, reducing stress, and building a secure future. Whether you want to save more, pay off debt, or manage your money more effectively, here’s how to build a better budget for the year ahead.

8 Tips for Building a Better Budget in 2025

Reflect on the Past Year’s Finances

Before diving into a new budget, take stock of your financial habits over the past year. Analyse your income, spending patterns, and savings. Did you overspend in certain areas? Were there unexpected expenses that disrupted your financial plans?

Use this reflection to identify areas for improvement. For example, if dining out consumed a significant portion of your budget, you could allocate more resources toward meal planning at home. Understanding where your money went provides valuable insights into building a more realistic and tailored budget.

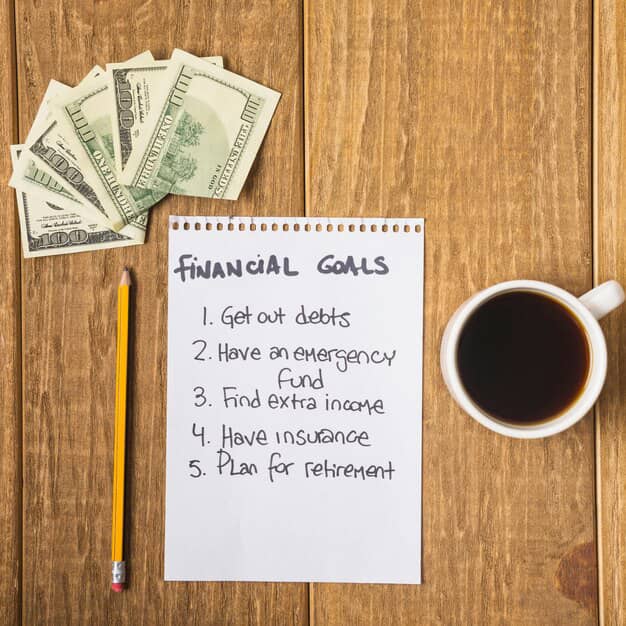

Define Your Financial Goals

A budget is more effective when it’s tied to specific goals. Ask yourself what you want to achieve financially in the new year. Goals could include:

- Saving for a vacation or a major purchase

- Building or bolstering an emergency fund

- Paying off credit card debt or student loans

- Investing in the future

Once you’ve set your goals, prioritize them. Use the SMART criteria—specific, measurable, achievable, relevant, and time-bound—to ensure they’re actionable. For instance, instead of saying, “I want to save more,” aim for “I want to save $5,000 for an emergency fund by December.”

Determine Your Income and Expenses

Calculate your total monthly income, including all sources such as salary, side hustles, or passive income. Next, list all your expenses. Categorize them into fixed costs (e.g., rent, utilities, insurance) and variable costs (e.g., groceries, entertainment, travel).

Don’t forget irregular expenses like annual subscriptions, car maintenance, or holiday spending. Review bank and credit card statements from the past few months to ensure accuracy. This will help you identify spending patterns and account for less frequent expenses.

Adopt the 50/30/20 Rule

A popular budgeting method is the 50/30/20 rule, which allocates:

- 50% of your income to needs (e.g., housing, groceries, transportation)

- 30% to wants (e.g., dining out, hobbies, entertainment)

- 20% to savings and debt repayment

This approach ensures you’re covering essentials, enjoying life, and making progress toward your financial goals. Adjust these percentages as needed based on your unique circumstances.

Track Your Spending

Budgeting doesn’t end with planning—it requires consistent monitoring. Use budgeting apps, spreadsheets, or even a notebook to track your expenses. Tracking helps you stay accountable and identify areas where you might be overspending.

Prepare for the Unexpected

Life is unpredictable, and unexpected expenses can derail even the best budgets. Building an emergency fund is crucial for financial stability. Aim to save at least three to six months’ worth of living expenses. Start small if necessary, and contribute consistently over time.

Automate Your Finances

Automation can simplify budgeting and help you stay disciplined. Set up automatic transfers to savings accounts, retirement funds, or debt payments. This “pay yourself first” approach ensures you’re prioritising your goals without relying on willpower alone.

Review and Adjust Regularly

A budget is not static—it should evolve with your circumstances. Schedule monthly check-ins to review your progress and make necessary adjustments. For example, if you receive a raise, decide how to allocate the extra income to align with your goals.